International Student Services supports and enhances the academic, social and personal experience of all international students at Minneapolis College.

The office can help you get answers to questions related to international student services.

Including:

1. Apply for Admissions as an International Student

For complete instructions, please visit our Application webpage.

2. Maintain Your F-1 Status

Your visa status refers to your ability to follow the regulations of the F-1 visa, outlined by the Student and Exchange Visitor Program which is tracked by your school’s Designated School Official through the Student and Exchange Visitor Information System (SEVIS). It is your responsibility to maintain your F-1 student status.

To maintain visa status, it is important to make sure you:

- Have a valid passport- If your passport is expiring in the next 6 months, start the process to apply for a new passport through the nearest embassy or consulate.

- Follow all employment regulations. Working off campus without authorization will result in a loss of active visa status. See the Employment Options section for more information.

- Attend classes at the school that issued your I-20 form.

- Enroll and stay enrolled in a full course of study (12 credits) during Fall and Spring semesters.

OR

- Obtain authorization for a Reduced Course Load (RCL). See the International Student Services Forms section on the bottom of this page to access the RCL form.

- Enroll in a minimum of 9 or more credits of courses that have a delivery method of ‘on campus’, ‘blended/hybrid’, or ‘mostly online’ when taking 12 credits or more. If on an RCL authorization, you must have one course that is one of the above delivery methods.

- Meet the Satisfactory Academic Program (SAP) Standards. Click to view the standards for GPA and completion rate to avoid academic suspension.

- International Students may not fall below 12 credits at any time during the semester. Instructors are required to report to the Records Office that a student has not attended or participated in their course for two weeks. College policy states that the Records Office must administratively withdraw the student from a course in the middle of a semester.

To avoid an administrative withdrawal by your instructor and academic suspension:

- Read the course syllabus on day 1.

- Attend classes and participate/submit coursework regularly.

- Ask for help and/or get a tutor through the Academic Success Center.

- Communicate with your instructor if you are struggling or get sick.

Should you figure out that a professor has withdrawn your enrollment from a course and you now have less than 12 credits for the semester, contact the International Student Advisor immediately.

3. Employment Options for International Students

On-campus Employment Opportunities

On-campus employment opportunities for international students are limited and not guaranteed. Students can find open positions on the Minneapolis College Job Bank. The hiring cycle coincides with the transition between terms (August, December/January and May). Students can make an appointment in Navigate to get help from Career Services (T.2300) with resume and cover letter writing if necessary.

Eligibility

- Active F-1 status.

- Enrolled at least 6 credits Minneapolis College per term.

- F-1 students must apply for a Social Security card after receiving a job offer and complete all paperwork with Human Resources before starting the position.

Hours/Limitations

- All student employees are only allowed to work on the Minneapolis College campus a maximum of 20 hours/week. Though the federal regulations state that international students can work more than 20 hours a week during breaks, the school does not allow any student more than 20 hours a week.

Off Campus Employment options:

Curricular Practical Training (CPT)

CPT allows a student to work in a job directly to the student’s major area of study before degree completion.

Eligibility

- Active F-1 status.

- Completed one academic year (2 semesters).

- Must be a currently enrolled in an internship class (at least 1 credit) that is a part of a declared degree program/major.

- Must obtain a job or internship directly related to current field of study.

- Can be paid or unpaid employment.

- Must have an internship/job offer and complete CPT application to request authorization from International Student Advisor.

- Must receive authorization by getting a new I-20 before beginning employment.

- Can be Part Time (20 hours a week or less) or Full Time (over 20 hours a week).

- Eligibility for OPT is void if student completes 2 semesters of Full Time CPT.

Optional Practical Training (OPT)

OPT must also be directly related to the student’s major area of study. Most students who take advantage of OPT apply for Post-Completion OPT, and work full time after graduation, but some will choose to apply for Pre-Completion OPT and work while attending classes. Pre-completion OPT is limited to 20 hours a week or less during the Fall and Spring semesters.

- The I-765 application with USCIS for the Employment Authorization Document (EAD) which requires a 2-3 month processing period.

Eligibility

- Active F-1 status.

- Completed one academic year (2 semesters).

- Apply for post completion OPT no more than 90 days before your program end date and no later than 55 days after your program end date.

- No offer letter is required for the OPT application but students on OPT cannot exceed 90 days of unemployment during the 12 month OPT authorized period.

- To apply: Meet with International Student Advisor (make an appointment in Navigate) ) to go over the US Customs and Immigration Services I-765 application for an Employment Authorization Document (EAD) or work permit.

4. Mandatory International Student Health Insurance

As a member of Minnesota State, Minneapolis College must abide by the policy from the system office for international student health insurance. International students must purchase the system-approved student health insurance, per the Minnesota State policy (the applicable section of the policy [Part 5 Subpart B] is copied below.) You can also download the full Minnesota State policy.

Subpart B. Economic Self-Sufficiency.

- Prior to being admitted to a college or university, an international student must demonstrate economic self-sufficiency to be able to afford the costs of tuition and fees, books and supplies, room and board, transportation, and any other costs necessary (such as health insurance) for the completion of the academic year.

- International students must purchase the system-approved student health insurance, (United Healthcare Student Resources) except those students whose sponsoring agency or government certifies that the student is covered under a plan provided by the sponsoring agency or government.

Therefore, students may have supplemental insurance such as employer insurance, spousal insurance, state insurance (if applicable), but they must still maintain the UHCSR policy while attending with an F1- or J1- visa. If you have questions on who qualifies as a government sponsor or agency, please contact Keswic Joiner, Director of Risk Management at the Minnesota State system office or call 651-201-1778.

Payment information for United Healthcare Student Resources

The policy year starts August 10 of each year and lasts until the following August 9.

For Fall semester insurance coverage, you will see the charge for insurance premium for the full year on your Fall tuition statement around July 15.

For Spring/summer semester insurance coverage, you will see the charge for January-August on your Spring tuition statement in October. Fall insurance is approximately \$1,000 - \$1,100 for 144 days, and Spring/summer insurance is approximate \$1,300 - \$1,400 for the remaining 221 days.

Payment for Fall semester must be made by the deadline in early August to stay registered in your Fall classes. Payment for Spring semester must be made in full before you can register for Spring semester courses.

Please prioritize paying for insurance before paying tuition. It is NOT possible to add the insurance to a monthly payment plan. Only tuition can be paid monthly. Once the premium is paid, Minneapolis College ISS will enroll you in the insurance policy. The insurance coverage will be retroactive to the first day of the policy year in August (for Fall coverage) or January 1 (for Spring/summer coverage).

United Healthcare Student Resources (UHCSR) Account Access Instructions

To access your account: go to visit the United Healthcare website OR Download the App: search “uhc studentresources” in your appstore.

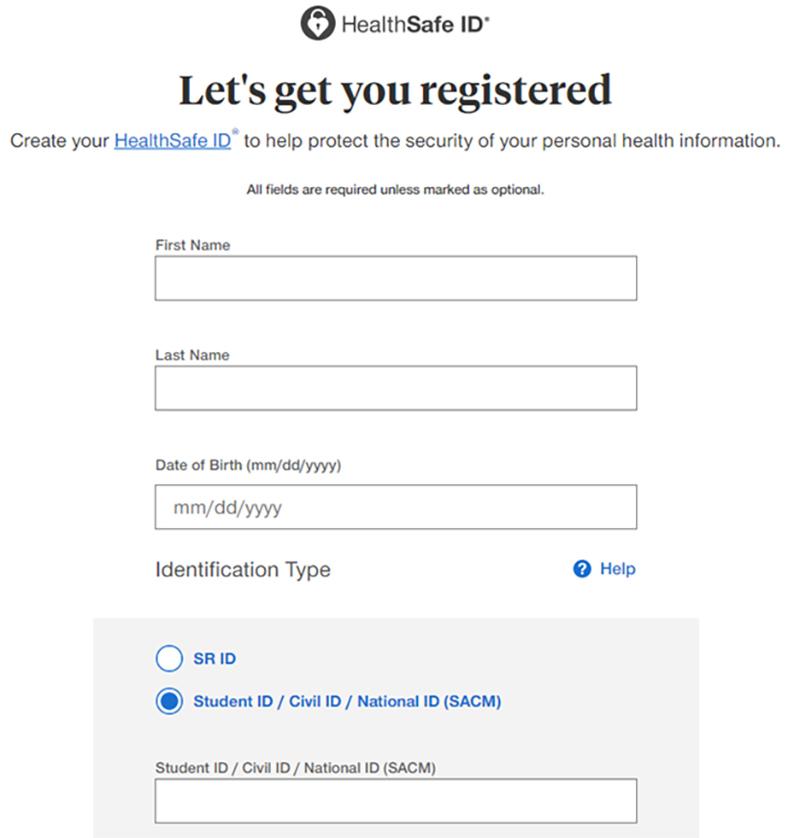

To create an account (new students) go to visit the United Healthcare website and click “Login to My Account” on the top right corner, and then click “Register Now” to create your HealthSafe ID.

See below for an example.

Create your account with your student ID, not the SR ID. (Find your Student ID by signing into eServices. It will be near the logout button in the top right of your eservices account.)

Then you will create a username and password. Please save this information for later. You will need it to access your insurance account.

Once you get to the Dashboard/Homepage of your account, you can view more information about the policy, print off your insurance card (or request the company send you one in the mail) and more.

Please note: Your insurance card will NOT automatically arrive in the mail: you must request it in your account.

Instructions to Find a Health Care Provider

First here’s some background on the US healthcare system:

Think of health insurance as a contract between you and the insurance company. When you buy insurance, the company agrees to pay part of your medical costs. Health insurance helps cover the costs of care like emergency room visits, medicine, and regular check-ups with your doctor so you and your family can stay in good health. It is important to find a medical professional who is “in-network”. This means the insurance company has a contract with the clinic or hospital to cover the treatments and services you need.

To search for a healthcare provider that is in the UHCSR network:

- Visit the United Healthcare website.

- Click on “Medical” or “Behavioral” under “Find providers”. (Only choose Dental if you have purchased the optional Dental Plan).

- Click “Change Location” to type in desired zip code (55_ _ _) to search near the school (55403) or near your home. Many students click on the box “places” to find a primary care clinic.

What to bring to the clinic: insurance card or printout, or your phone with the UHC student resources app and account created.

Within your insurance account, you can view the claims processed by the clinic through your insurance after the visit. You may receive messages from the insurance company regarding your claim. Please note that you must sign into your account on a computer to view messages or the claims records because the app will not have the option.

Other Useful Health Information

- UHCSR customer service: 1-888-251-6243 or contact customer service.

- Download the Insurance certificate and brochure for the current year:

- Refunds: The amount of the refund is pro-rated from the date of on the form until the end of the policy year. A paper check will be mailed 4 - 6 weeks after the refund request is submitted. Please find the refund form below complete your section, and submit the form to the International Student Advisor, who will approve the form and submit it to UHCSR.

- Download the Insurance Refund Request Form

5. Paying for Tuition

Tuition is due after you register for classes.

Please prioritize paying for health insurance first before paying tuition. To do this, please pay $300 of your tuition to stay registered.

Next, pay the health insurance fee. You can use a monthly payment plan to pay the rest of your tuition while you attend the classes.

The following are payment options for our international students:

- Flywire: a global leader in payment services accepted by Minneapolis College to process payments from outside the U.S. Visit the Flywire Payment Link for access.

Visit the Making Your Payment webpage for information on the following other options:

- Online through eservices.

- In person or by mail.

- Enroll in an automated or monthly payment plan.

Please note that Financial Aid is not available for international students.

6. Tax Information for International Students

All international students must file taxes if present for any part of the previous calendar year. Tax season begins every year at the end of January and ends on the 15th of April (or the following Monday, if the 15th falls on a Saturday or Sunday.)

If you did not work or receive any income but you were present in the United States for the previous calendar year, you are legally obligated to file the Form 8843. If you worked or received a stipend, grant or allowance in the United States, you may also need to file the Form 1040-NR. (The NR stands for Non-Resident.)

Many students use Sprintax, the leading software available to international students to complete the 1040NR. Please note there is a fee for the services through Sprintax (approximately $80).

Another option is The NonResident Tax Help Group (NoRTH)

This option is free, but an appointment is required and they fill up quickly. Click the link above early during tax season to secure your appointment.

Please Note: The International Student Advisor is not a tax expert and cannot advise students on how to complete the tax forms.

What documents do I need to file taxes?

Form 8843

Click to complete the Form 8843 via the online wizard (guide).

- Passport

- US Entry and Exit Dates

- Form I-94 Arrival-Departure Record

- Form I-20

- Social Security Number (SSN) if you have one.

1040-NR

- Current and all previous passport information

- Form I-20

- Form I-94

- Current U.S. address and/or Foreign Permanent Address

- U.S. Entry and Exit Dates for current and past visits to the U.S.

You may also receive one or more of the following documents in the mail:

- Form W-2: Wage and Tax Statement from Minneapolis College’s Payroll Office and/or your CPT/OPT employer if you received compensation for your work.

- Form 1042-S: Foreign Person’s U.S. Source Income Subject to Withholding from Minneapolis College’s Business Office if you have received scholarships more than the tuition and mandatory fees charged to your student account.

- Form 1099 series reporting various types of your income other than wages, salaries, and tips- a common case is your interest income report from your financial institution.

- Form 1095 Proof of insurance from health insurance company. UHCSR policy holders generally receive this via email unless you request a paper copy sent via regular mail.

If you have questions about your Form W-2 from Minneapolis College, please refer your questions to the Business Office. If you have questions about your Form 1042-S from Minneapolis College, please refer your questions to the Business Office in T.2100. The best way to contact them is to submit your question to ASK US!

Am I Considered a Non-resident Alien or Resident Alien for Tax Purposes?

Most of you are Non-Resident Aliens for Tax Purposes UNLESS you have been in F or J status during any part of more than five calendar years.

Please click here to use find out if you are a resident or non-resident for tax purposes.

Here is more information if you qualify to be a resident but do not wish to be treated as a Resident for tax purposes.

This status is for tax purposes only. Please do NOT confuse this with your immigration status. All international students are non-immigrant, non-resident aliens for immigration purposes.

What Tax Form Should I Use?

Non-Resident Alien

I have W-2, 1042-S, or 1099 form(s)

I DO not have W-2, 1042-S, or 10992 form(s)

Resident Alien

I have W-2, 1042-S, or 1099 form(s)

I DO not have W-2, 1042-S, or 10992 form(s)

- None

If you are considered a resident alien with W-2, 1042-S, or 1099 Form(s), you must file the Form 1040. An online service is TurboTax. Please do research and find a tax service that best fits your need.

Where should I send my tax forms?

Electronic filing is encouraged for Form 1040NR. If you are sending Form 8843 only or with the Form 1040, mail them to:

Department of the Treasury

Internal Revenue Service Center

Austin, TX 73301-0215

More Resources

- IRS webpage on Tax Issues for Foreign Students and Scholars.

- U.S. Dep. of Homeland Security’s webpage on F-1 and M-1 Students: Obtaining a Social Security Number.

- U.S. Social Security Administration’s webpage on Social Security Information for on-Citizens.

7. Travel Signature

Your I-20 must have a valid signature each time you leave the U.S. and want to reenter. Please stop by open office hours or make an appointment to see your international student advisor at least two weeks before your scheduled travel date to get the signature. Ideally, you will bring in your printed I-20 to the international student advisor during open office hours. In some cases, it’s possible to get a new I-20 with a travel signature sent via email.

The signature is typically good for one year of travel unless you have graduated and are now on post-completion practical training, in which case it is only good for six months.

Every F-1 student or F-2 dependent will need to present these documents to reenter the U.S.:

- Properly endorsed and valid I-20 form

- Evidence of financial support

- Valid passport with a valid U.S. entry visa stamp

- All previously issued I-20's to document your F-1 history in the U.S.

- Employment Authorization Document and proof of employment (only if you are in engaged in Optional Practical Training after completion of studies.)

8. Renew Your United States Visa

If you need to travel outside the U.S. and have an expired F-1 visa, a new entry visa is required to re-enter the country. Students must travel to their home country to renew their visa. It cannot be done inside the U.S. or in Canada/Mexico.

- Please note: There may be significant delays before a visa application is approved. Applications should be submitted to the U.S. embassy or consulate as soon as possible.

- Many U.S. embassies/consulates require pre-arranged appointments.

- Check the embassy/consulate website for information on scheduling.

There may be a need for a security clearance before a visa will be granted. Whether you will need a security clearance will depend upon your nationality, country of citizenship, countries visited in the past and your field of study or expertise. The security clearance can take 20 or more days to complete.

For an F-1 non-immigrant visa application, the embassy or consulate minimally requires:

- Passport valid for travel to the United States – Your passport must be valid for at least six months beyond your period of stay in the United States.

- Nonimmigrant Visa Application, Form DS-160 confirmation page.

- Application fee payment receipt, if you are required to pay before your interview.

- Photo – You will upload your photo while completing the online Form DS-160.

- Form I-20 with a travel signature. contact the International Student Advisor to arrange getting the form signed.

For more information, click here.

9. International Student Services Forms

Please submit forms and other documentation to the ISS Document Submission eform. Star ID and password required to access the form.

List of downloadable PDFs (fillable and accessible):

For requests to take less than 12 credits in a spring and fall semester. Please contact the international student advisor before submitting this form to make sure you understand the requirements and have the correct documentation.

For requests to extend the program end date on the I-20 form.

For requests to drop or withdraw from a course when eservices won’t allow it.

To apply for CPT, please contact the international student advisor before submitting to make sure you understand the requirements and have the correct documentation.

For requests to end the F-1 student visa status. Please contact the international student advisor before submitting to make sure you understand the requirements and have the correct documentation.

List of online forms through U.S. Citizenship and Immigration Services (USCIS):

For requests to ‘re-activate’ SEVIS record after falling out of status

To apply for the work authorization for pre-completion or post-completion OPT. Please refer to the Employment Options for International Students section above for further information.